The Seren Difference Sets Us Apart

Small Business Expertise

With years of experience starting, operating and helping small businesses thrive, our team understands your challenges. We offer more than just loans—we offer expert advice and solutions that promote sustained growth and long-term success.

.

Banking Industry Expertise

With a deep understanding of the lending process and the overall banking industry, we structure financing solutions that are both practical and profitable for your business. Our trusted and tailored funding options ensure you get the best terms, not just any deal.

Building Valued Partnerships

We believe in building relationships, not just transactions. Our approach is consultative and low-pressure. We’re here to provide solutions that are right for your business, not to pressure you into a deal. Our valued partnerships mean we are committed to your sustained success.

Tired of Pushy Loan Brokers?

Did you know that when you submit an online inquiry for funding, your information could be sold and shared with numerous salespeople across the industry?

We’ve heard it from business owners countless times—after inquiring about financing online, you’re bombarded with endless calls, texts, and emails from aggressive loan brokers. The hard sell can feel relentless, and often their goal is to push you into a transaction that benefits them, not you.

At Seren Business Capital, we’re different. We believe in building relationships, not just transactions. Our approach is consultative and low-pressure. We’re here to provide solutions that are right for your business, not to pressure you into a deal.

Say goodbye to pushy brokers and hello to a financing partner who cares about your business’s success. At Seren Business Capital, we’re here to help your business thrive.

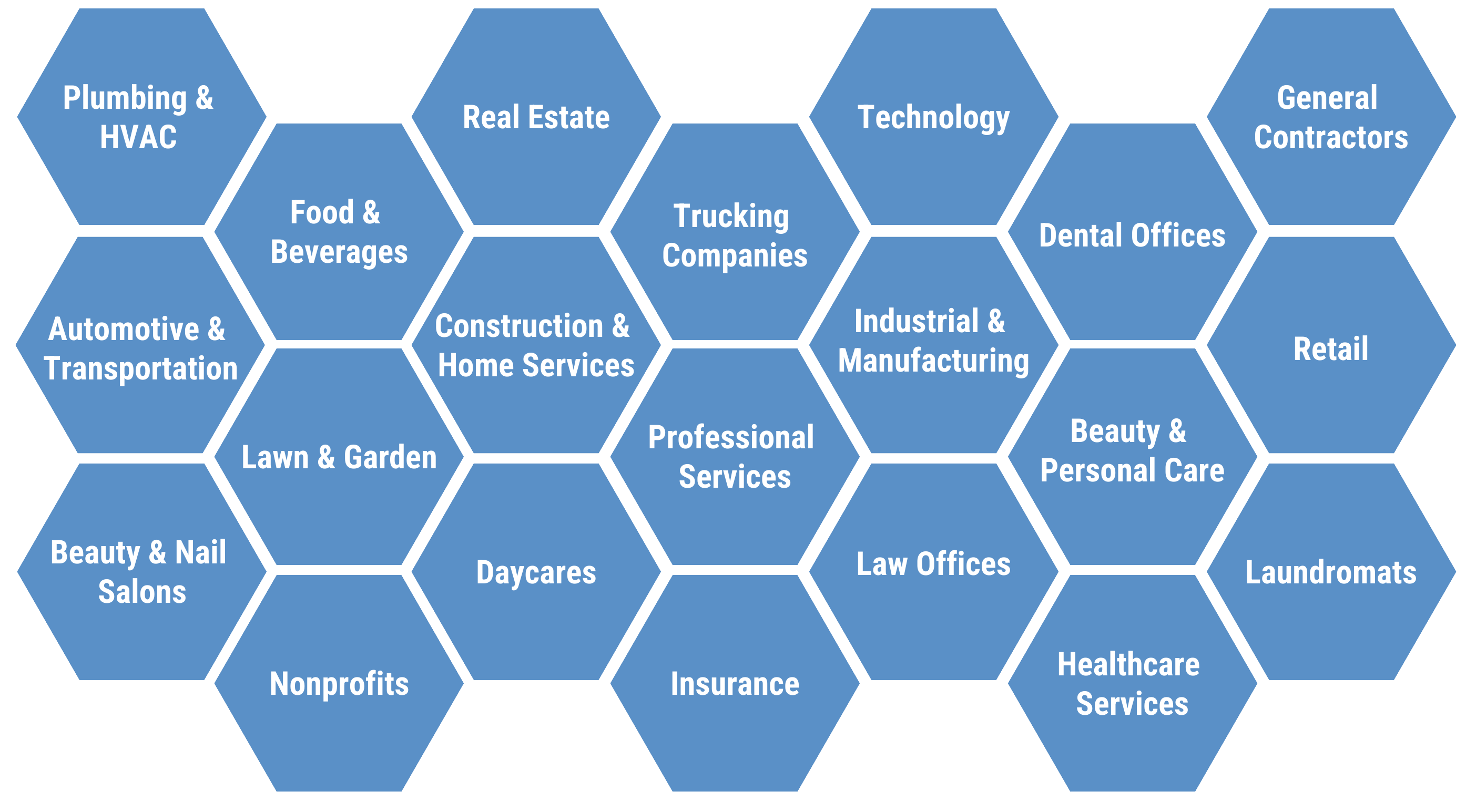

Industries | Businesses

We proudly support a wide array of businesses across diverse industries. We work with businesses ranging from construction, real estate, and manufacturing to healthcare, technology, and retail. Whether you run a small beauty salon, a trucking company, or a nonprofit, we provide tailored funding solutions to meet your unique needs and ensure your business has the resources needed to grow and succeed.

Our Funding Programs

Featuring one of the largest funding networks in the industry, we match small business owners with over 200 banks, non-bank lenders, and direct funding providers in record time and with no upfront fees or commitments. Our platform seamlessly processes applications to get small businesses approved and funded in as little as 24 hours or even same day.

Are You Ready To Take The Next Step?

Schedule a free consultation with one of our trusted advisors today. We’ll take the time to understand your business, offer insights and guidance, and present the financing options that work best for you.

Our Office

204 Hidden Lake Road

Hendersonville, TN 37075

Contact Us

629.228.8767

info@serenllc.com

Office Hours

Mon-Fri: 8am – 8pm

Sat-Sun: By Appointment

Follow Us

We collect data to improve your browsing experience and to recommend valuable services.

By continuing to use this website you consent to our privacy policy and terms and conditions.